- The Morning Post

- Posts

- Economy Sinks, Trump Collects Millions & Diddy Guilty

Economy Sinks, Trump Collects Millions & Diddy Guilty

In a captivating interview with CBS News, Iranian Foreign Minister Abbas Araghchi claimed that recent U.S. airstrikes have "heavily and seriously damaged" Iran's nuclear facilities. As tensions escalate, Araghchi expressed skepticism about the immediate resumption of negotiations with the U.S. but left the door open for potential diplomacy down the line.

This significant moment marks his first engagement with a Western media outlet since the strikes, shedding light on Iran's current stance and the fragile state of international relations. As the political landscape continues to shift, both Iran and the U.S. are navigating complex issues that could shape their future interactions.

In a sweeping move, Microsoft has announced it will lay off nearly 9,000 workers, representing just under 4% of its global workforce. This latest round of job cuts follows earlier layoffs of over 6,000 employees and is part of the company’s strategy to streamline operations and enhance agility in a rapidly evolving market.

A spokesperson highlighted the need for organizational changes to position teams for success while reducing management layers. Despite this trim, Microsoft remains a financial powerhouse, boasting nearly $26 billion in net income for its last quarter and a market cap of $3.

7 trillion. As the tech giant continually adapts to new technologies, the changes aim to foster a more efficient and meaningful work environment for its remaining employees.

Sean "Diddy" Combs has been convicted on two counts related to prostitution, while acutely avoiding a guilty verdict on charges of sex trafficking and racketeering. The jury's decision marks a significant chapter in the high-profile trial that has captivated audiences.

Although Diddy faced five allegations, he emerged with his reputation somewhat intact, managing to dodge the more serious accusations that weighed heavily on the court’s proceedings. With mixed reactions sweeping through fans and the entertainment industry, the verdict underscores the complexities of celebrity trials and the balancing act of public personas and legal battles.

As Diddy navigates the aftermath, supporters and critics alike are eager to see how this turn of events will influence his career and personal life moving forward.

Paramount Global has struck a $16 million deal with Donald Trump to settle a lawsuit he filed over a controversial CBS interview featuring Kamala Harris on "60 Minutes." Trump accused the network of deceitful editing that favored the Democratic Party, claiming it misrepresented Harris's responses to key questions.

While Paramount's payment is designated for Trump's future presidential library, there was no apology or regret issued by the company. A spokesperson for Trump's legal team celebrated the settlement as a victory for the American public against "fake news media," asserting the case's strength forced CBS to capitulate.

As part of the agreement, 60 Minutes will also provide transcripts of future presidential candidate interviews. As tensions arose during the settlement negotiations, some CBS executives left their roles, showcasing the internal conflict over the potential implications of the deal.

This settlement marks another instance of a media company accommodating Trump's legal challenges.

In a revealing discussion, economist Gerald Epstein argues that Donald Trump’s administration is on a reckless path towards dismantling essential financial regulations, potentially setting the stage for another major financial crisis. The push for deregulation, particularly in the cryptocurrency space, puts the economy at significant risk, with Trump and tech magnates, like Elon Musk, seeking to create a largely unregulated financial frontier.

Epstein warns that these trends, marked by increasing debt and lack of oversight, could lead to a “Wild West” financial system, heightening opportunities for fraud and corruption. He highlights that the consequences extend beyond market instability to daily harms inflicted on workers and communities.

With both major political parties complicit in this drive towards deregulation, Epstein calls for a rejection of “Trumpism” and related crony capitalism to safeguard the economy and promote fairness in financial services.

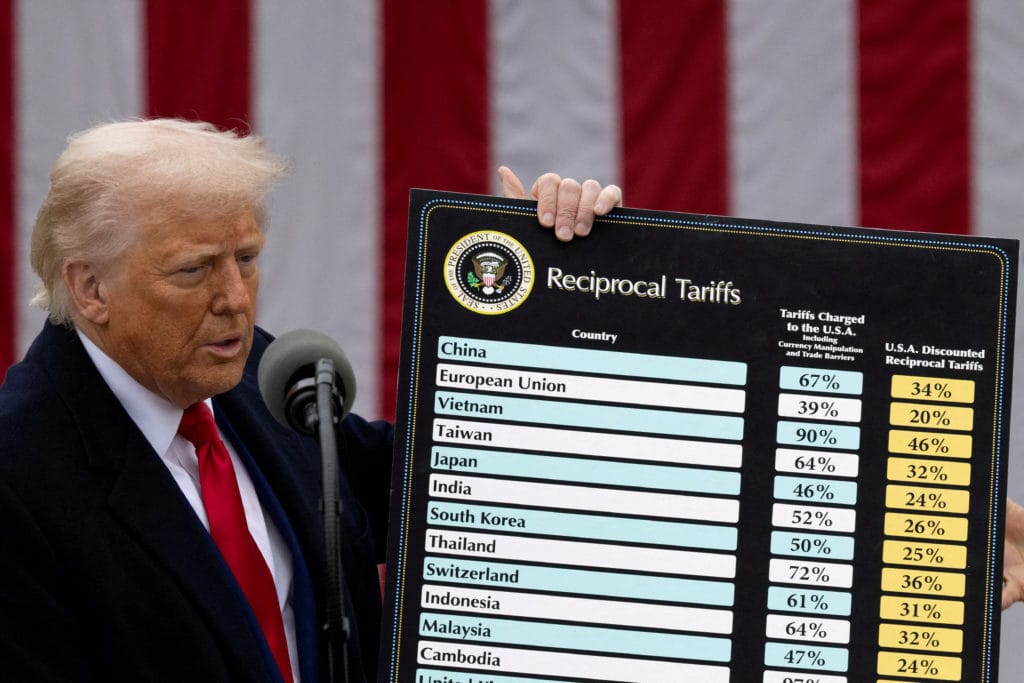

A recent analysis from the JPMorgan Chase Institute reveals that President Trump’s tariffs could burden U.S. employers with a staggering $82.3 billion in costs.

This hefty price tag might lead to price increases, layoffs, or hiring freezes, particularly affecting businesses reliant on imports from China, India, and Thailand. While companies like Amazon and Walmart have managed to delay the financial impact by stockpiling inventory, the looming tariffs pose significant risks for a wide swath of the economy.

Although Trump asserts that foreign manufacturers will absorb these costs, evidence suggests that American companies and consumers may feel the pinch. With the July 9 deadline approaching for formal tariff rates, uncertainty bubbles as negotiations unfold, leaving businesses to navigate potential economic fallout.

The implications of these tariffs not only threaten company profit margins but could also ripple through to consumers, sparking inflation concerns that could reshape the U.S. economic landscape.

In a surprising turn of events, the US private sector experienced a loss of 33,000 jobs in June, marking the first negative month in over two years. This stark contrast to economists' expectations of a 115,000-job gain raises eyebrows and highlights a weakening labor market.

According to ADP’s report, uncertainties around hiring plans have contributed to this downturn, though wages still show resilience. As businesses hesitate to expand their workforce or replace departing employees, concerns grow about potential broader economic implications.

Economists remain cautious about upcoming job reports, with predictions indicating a potential increase in the unemployment rate to 4.3%.

With factors like federal spending cuts and tariffs adding pressure, the job landscape is shifting, underscoring the challenges ahead for the economy as companies grapple with a mix of hesitancy and hope.

Federal Reserve Chair Jerome Powell revealed that interest rates would likely have been cut this year if not for the impact of tariffs imposed by President Trump. Speaking at a central banking forum in Portugal, Powell noted that the Fed's cautious approach stems from uncertainties surrounding the economic effects of these tariffs.

This admission has sparked criticism from Trump, who has publicly berated Powell for maintaining higher rates, labeling him a “numbskull.” Despite some Fed officials suggesting that a rate cut could be on the horizon, Powell emphasized that any decisions would depend on inflation trends and labor market conditions.

The Fed remains committed to a data-driven, non-political stance, prioritizing economic stability over outside pressures. As the anticipation for potential cuts grows, Powell reassured that the central bank aims to act responsibly in the best interest of the economy, while navigating the political storm surrounding their decisions.

Spread the word!

Don’t keep us a secret, forward this email to your friends.

Thanks for reading Morning Post Online! Subscribe for free to receive latest news and support our work.